Healthcare costs can quickly add up, especially if you or your family members require regular medical attention. That’s why many Americans are turning to HSAs to better manage and even save money on these expenses. If you’re unfamiliar with HSAs or simply want to know how to better utilize them, you’ve come to the right place.

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account specifically for medical expenses. It’s like a personal savings account, but the money you save can only be used for qualified health expenses. HSAs are available to individuals who have a high-deductible health plan (HDHP).

Benefits of an HSA:

- Tax Deductions: Contributions made to your HSA are tax-deductible, which can help reduce your taxable income.

- Tax-Free Growth: Any interest or other earnings on the money in the account are tax-free.

- Tax-Free Withdrawals: Money taken out for qualified medical expenses isn’t taxed.

- Portability: An HSA is yours to keep, even if you change jobs or health insurance plans.

- Rollover: Unlike some other health-related accounts, HSAs don’t have a “use it or lose it” policy. The money rolls over year after year.

How Can You Use an HSA to Save Money?

- Start Early and Contribute Regularly: Just like any other savings account, the sooner you start contributing to your HSA, the better. Over time, even small, consistent contributions can add up, especially when considering the tax-free growth potential.

- Understand Qualified Expenses: HSAs cover a wide variety of medical expenses, not just doctor’s visits and prescription medications. They can also be used for dental care, vision care, and over-the-counter medications, among others. By being aware of what’s covered, you can ensure you’re utilizing your HSA to its full potential.

- Invest Wisely: Many HSAs offer investment options. Depending on your comfort level and risk tolerance, you can invest in mutual funds, stocks, or bonds to help your savings grow even more. Always make sure you’re aware of any fees or charges associated with investing.

- Avoid Non-Qualified Withdrawals: Using your HSA funds for non-qualified expenses can lead to taxes and penalties. Ensure you’re using the money strictly for healthcare-related expenses.

- Combine with Other Savings: If you have a Flexible Spending Account (FSA) or other health-related savings or reimbursement plans, use them strategically with your HSA. For instance, you might use your FSA for predictable expenses like prescriptions and your HSA for unexpected medical costs.

Tips for Maximizing Your HSA:

- Stay Informed: Healthcare and tax laws change. Ensure you’re up to date on contribution limits, qualified expenses, and other HSA-related regulations.

- Track Your Expenses: Keep all your medical receipts. This not only helps you stay organized but also ensures you’re reimbursed for every penny you’re entitled to.

- Review Your Options: If you’re not satisfied with your HSA provider, remember you can transfer your funds to a different HSA account. Look for accounts with low fees, good investment options, and excellent customer service.

- Consider Future Healthcare Needs: If you’re planning a significant medical procedure or anticipating increased medical expenses in the upcoming year, adjust your contributions accordingly.

Health Savings Accounts offer a triple tax advantage and are an excellent tool for those looking to save money on healthcare expenses throughout the year. When paired with a high-deductible health plan, they can significantly offset medical costs and provide peace of mind.

Like all financial tools, the key to making the most of an HSA is understanding how it works and being proactive in managing and contributing to it. With the right strategy, an HSA can be an essential part of your healthcare and financial planning.

Understanding the New HSA Rules for 2024

Health Savings Accounts (HSAs) have become increasingly popular in recent years as a way for individuals and families to save for healthcare expenses while enjoying certain tax benefits. In 2024, several new HSA rules and changes have been introduced, and it’s essential to understand these updates to make the most of your HSA. This blog post will walk you through the key changes in HSA rules for 2024.

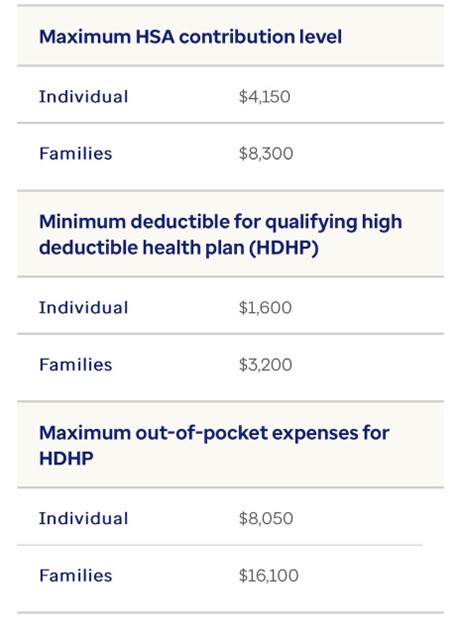

Increased Contribution Limits: One of the significant changes in HSA rules for 2024 is an increase in contribution limits. Individuals with self-only coverage can now contribute up to $4,150 (up from $3,850 in 2023), while those with family coverage can contribute up to $8,300 (up from $7,750 in 2023). These contribution limits include both your own contributions and any contributions made by your employer.

Catch-Up Contributions: For individuals aged 55 and older, the catch-up contribution limit remains the same at an additional $1,000. This allows older individuals to save more in their HSAs to cover healthcare expenses in retirement.

High Deductible Health Plan (HDHP) Eligibility: To be eligible to open and contribute to an HSA, you must have a High Deductible Health Plan (HDHP). In 2024, the minimum deductible for an HDHP is $1,600 for self-only coverage and $3,200 for family coverage. The maximum out-of-pocket expenses for HDHPs for 2024 are $8,050 for self-only coverage and $16,100 for family coverage.

Qualified Medical Expenses: HSA funds can be used tax-free to pay for qualified medical expenses. While most medical expenses are considered qualified, it’s essential to be aware of any changes or updates to this list. For example, some over-the-counter medications and menstrual care products may now be eligible for HSA funds without a prescription.

Rollover of Funds: One of the benefits of HSAs is that unused funds can roll over from year to year. In 2024, the maximum rollover amount remains unlimited. This means that you can continue to accumulate funds in your HSA over time, allowing for significant savings for future medical expenses.

Non-Medical Withdrawals: If you withdraw funds from your HSA for non-medical expenses before age 65, you will face a 20% penalty in addition to regular income tax. However, after age 65, you can withdraw funds for non-medical expenses without the penalty, though you will still owe income tax on the withdrawals.

Health Savings Accounts are a valuable tool for saving for healthcare expenses and enjoying tax benefits. In 2024, the new HSA rules bring increased contribution limits, catch-up contributions, and changes to qualified medical expenses. Understanding these rules can help you make informed decisions about your HSA and ensure you maximize its benefits. Be sure to consult with a financial advisor or tax professional for personalized guidance on your HSA strategy in 2024.